Discover the very best Credit Union in Cheyenne Wyoming: Trusted Financial Support

Discover the very best Credit Union in Cheyenne Wyoming: Trusted Financial Support

Blog Article

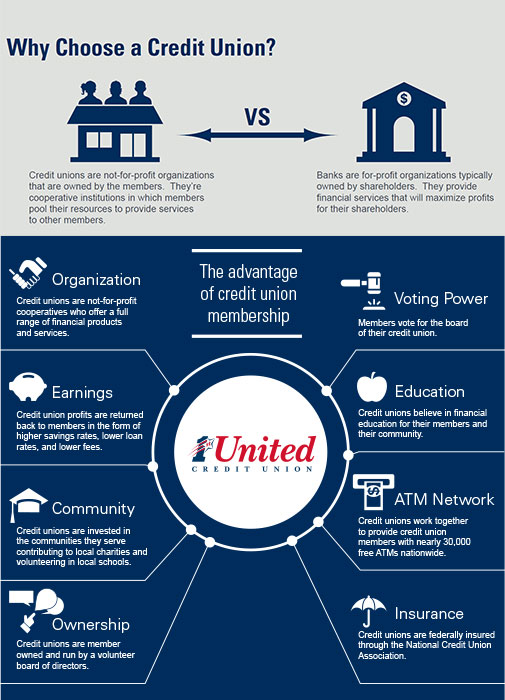

Why You Need To Pick Cooperative Credit Union for Financial Stability

Cooperative credit union stand as columns of monetary stability for numerous individuals and communities, providing a distinct method to banking that prioritizes their participants' health. Their dedication to reduce costs, competitive rates, and personalized consumer solution establishes them besides conventional banks. But there's even more to credit rating unions than simply economic advantages; they also foster a feeling of neighborhood and empowerment among their participants. By choosing lending institution, you not only protect your financial future yet likewise become component of a helpful network that values your financial success.

Reduced Fees and Affordable Prices

One of the key benefits of credit scores unions is their not-for-profit structure, allowing them to focus on participant advantages over optimizing earnings. Furthermore, credit score unions commonly give a lot more competitive rate of interest rates on savings accounts and loans, converting to far better returns for members and lower loaning expenses.

Personalized Consumer Solution

Offering tailored aid and customized services, lending institution prioritize tailored customer solution to satisfy members' details monetary needs successfully. Unlike conventional banks, cooperative credit union are known for growing a much more individual connection with their participants. This tailored strategy includes understanding each member's unique financial circumstance, objectives, and preferences. Lending institution team frequently put in the time to listen attentively to members' problems and offer tailored recommendations based on their specific needs.

One secret element of tailored customer support at credit report unions is the concentrate on monetary education and learning. Lending institution agents are devoted to assisting participants comprehend different monetary items and services, encouraging them to make informed choices (Credit Union Cheyenne). Whether a member is aiming to open up an interest-bearing account, use for a lending, or plan for retirement, cooperative credit union provide customized assistance every step of the way

In addition, lending institution often go above and beyond to make certain that their participants feel valued and supported. By constructing solid connections and fostering a sense of area, credit scores unions produce a welcoming setting where members can trust that their economic wellness is in good hands.

Solid Neighborhood Focus

With a dedication to fostering neighborhood links and supporting neighborhood campaigns, cooperative credit union focus on a strong neighborhood focus in their procedures - Credit Union Cheyenne WY. Unlike traditional financial institutions, cooperative credit union are member-owned banks that run for the benefit of their participants and the communities they offer. This one-of-a-kind structure permits lending institution to concentrate on the wellness of their participants and the local neighborhood as opposed to entirely on creating earnings for outside shareholders

Lending institution typically take part in various neighborhood outreach programs, enroller local events, and collaborate with various other companies to address neighborhood demands. By buying the area, credit scores unions aid boost neighborhood economies, produce task possibilities, and improve overall high quality of life for citizens. In addition, lending institution are understood for their participation in economic proficiency programs, supplying instructional resources and workshops to help community members make informed financial decisions.

Financial Education and Support

In promoting financial literacy and providing support to people in demand, credit score unions play an important function in encouraging areas in the direction of financial security. One of the vital advantages of credit score unions is their emphasis on providing financial education to their participants.

In visit addition, cooperative credit union typically supply help to members facing financial difficulties. Whether it's through low-interest car loans, flexible repayment strategies, or economic therapy, cooperative credit union are devoted to assisting their members conquer challenges and attain economic stability. This customized approach collections debt unions in addition to standard banks, as they prioritize the economic health and wellness of their members most importantly else.

Member-Driven Decision Making

Members of cooperative credit union have the chance to voice their opinions, provide feedback, and even compete settings on the board of supervisors. This level of engagement fosters a sense of possession and area amongst the members, as browse around this web-site they have a direct impact on the instructions and plans of the lending institution. By actively involving participants in decision-making, credit unions can much better customize their services to meet the one-of-a-kind requirements of their neighborhood.

Ultimately, member-driven decision making not only enhances the total member experience but additionally promotes transparency, trust fund, and responsibility within the lending institution. It showcases the cooperative nature of cooperative credit union and their commitment to serving the ideal rate of interests of their members.

Final Thought

In final thought, lending institution supply a compelling selection for financial security. With lower fees, affordable rates, customized customer support, a solid neighborhood emphasis, and a commitment to monetary education and learning and support, lending institution focus on participant advantages and empowerment. Via member-driven decision-making processes, cooperative credit union promote transparency and liability, guaranteeing a stable monetary future for their participants.

Credit history unions stand as columns of financial stability for several people and communities, using an unique method to financial that prioritizes their participants' health. Unlike traditional banks, debt unions are member-owned financial organizations that operate for the advantage of their participants and the areas they offer. Additionally, credit history unions are known for their participation in monetary proficiency programs, supplying instructional sources and workshops to help community members make informed financial decisions.

Whether it's through low-interest fundings, versatile settlement strategies, or economic therapy, credit scores unions are dedicated to assisting their members conquer difficulties and achieve economic security. With reduced costs, visit site affordable rates, customized customer service, a solid area emphasis, and a dedication to monetary education and assistance, credit scores unions prioritize participant advantages and empowerment.

Report this page